Are you a young physician clueless about financial matters? You’re not alone. A lot of young physicians are less than knowledgeable about what to do with money, especially with the sudden increase in income that comes about after residency. This is not surprising given that medical schools don’t usually offer any courses in financial planning. From what I’ve been able to gather, the overall process of financial planning shouldn’t be that hard, but you should have some basic framework. With some common sense, perseverance, and discipline, you will increase your likelihood of becoming financially secure.

Why are most doctors bad at managing money? In a 2011 New York Times article, “Investment Advice for Doctors: First, Do No Harm,” the author, Ron Lieber, cites hubris, tendency to trust others, and impatience to make money (after a long period of training) as factors in doctors making financial mistakes. A young physician is particularly vulnerable to these factors. At various points in my financial life, I have certainly been overconfident, gullible, and impatient. In this three-part series of articles, I hope to share with you some things I’ve learned in this area of financial planning (mostly through making mistakes), and I hope to convince you of certain basic and simple facts about financial planning that – I believe – will never go out of style.

In this article – part one – I will talk about a three basic, but important points to give you a mental framework. In parts two and three, I will try to delve into the specifics a little more.

Within 10 years of graduating from residency, by living below your means and saving, you should have…

So, how does financial security happen for physicians? Because of the relatively high income that physicians make, I think it’s easy to fall into the trap of thinking that he will be financially secure without too much effort, and that high income will translate into financial security. I don’t know about you, but I have never had a financial planning course in med school or residency. I tried to read a few books like ‘Personal Finance for Dummies’ to understand financial matters, but I was definitely not ready for the six-fold increase in income after training. I didn’t have a game plan for what to do with the high income.

Point #1: High Income Does Not Necessarily Make You Financially Secure.

You’re going to be making a high income – which you deserve – after all the hard work. Now the game is turning that high income into ‘wealth.’ I think it’s a mistake to think that people who make high income are necessarily wealthy. You’ve worked hard to be able to get a cool and gratifying job that pays well. Now the game shifts to turning that high income into wealth. I don’t mean the kind of wealth that – let’s say – Mark Zuckerberg has, but having financial security: having the means to provide for your family, send your kids to college, go on family vacation, save for retirement, etc.

Simply put, to become financially secure, you should focus on increasing your assets and decreasing your liabilities. Assets have a good chance to increase in value (a house, stocks, your own business, etc); liabilities are basically debts – things like your student loans, credit card debt, mortgage, etc. Taking out a big loan to buy an expensive car increases your debt: not a good idea. The only debts you should have are the ones financing things that have potential to increase in value: education, a home, etc. You should be financing these at the lowest interest rate possible, especially right now when the cost of borrowing money is at a historical low. You should seriously consider refinancing your student loans if the interest rate on them is above 6%.

So having assets and decreasing your debt burden is the name of the game. How do you go about it? This leads to point #2 and #3.

Point #2: Save, Save, Save, and Live Below Your Means.

Save as much money as you can especially during your first few years out, and live below your means. Living below your means does not mean not living well – an important distinction. Don’t expect that you will all of a sudden triple or quadruple your lifestyle after residency. Don’t go out and buy a Porsche. Don’t live up to other people’s expectations. I’m not telling you to live like a war refuge; just think for yourself and see how you want to spend your hard-earned money.

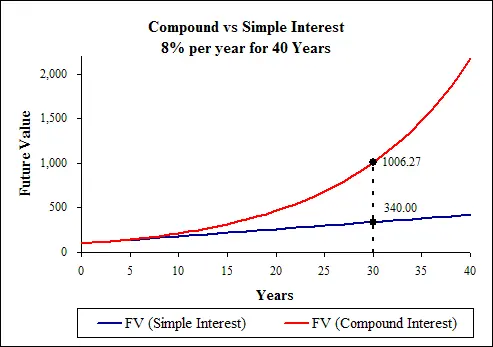

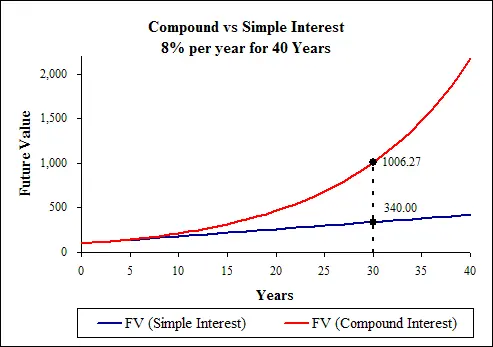

The earlier you start saving money and putting it to work in assets that have potential to increase in value, the more years you will benefit from compounding interest, a powerful friend when it comes to your future financial security. I can’t stress the importance of compound interest strongly enough.

Take a look at the graph comparing compound interest to simple interest. It’s obvious that the sooner you start saving and investing money, the sooner you will reach the steeper part of the curve where the effect of compounding interest is more powerful. When it comes to saving money, you’re likely to be behind your college friends who did not go into medicine. One of the most effective way of catching up to your friends is to save a high proportion of your post-training income and investing that money early, preferably straight out of training. This way, you can reach the steeper part of the compounding interest curve sooner. Also, as a young physician not too removed from residency (or fresh out), you will find it much easier to continue to be frugal and save; it’s harder to cut back on your lifestyle once having increased it.

This is hard after having delayed your gratification for a long time, but I think it’s a matter of just deciding that you’re going to be methodical and disciplined about translating high income into wealth.

Let’s say you had been making $50,000 as a resident, and now you’re making $300,000, first year out of residency. You’ll pay around $100,000 in taxes. If you give yourself a 100% increase in your spending budget and live on $100,000 (as opposed to $50,000 you had been as a resident), you’ll feel some improvement in your lifestyle. Now, if you use the rest – $100,000 – towards saving for a downpayment on a house, saving for retirement, and paying down debt, you will get a jump start in building wealth. Saving money and living below your means is probably the simplest way to become financially secure.

It seems so simple, but living below your means and saving money is a good thing for financial security. What should you be doing with the saved money? This leads to point #3.

Point #3: Have a Simple 10-Year Plan.

Within 10 years of graduating from residency, by living below your means and saving, you should have:

- Paid off all of your student loans as well as other debts (except for a mortgage).

- A sizable nest egg for retirement (especially in tax-advantaged vehicles like 401k, 403B, and IRA’s) at a level commensurate to your friends who didn’t go into medicine and therefore started to save for retirement earlier.

- A low interest-rate mortgage on a house in which you have a big equity by having paid at least a 20% downpayment.

The above three things should be your top financial goals within the first 10 years out of residency. Having a simple plan based on common sense will allow you to achieve those goals.

Does this mean that you can’t have a nice car or other luxury items that you’ve wanted for a while? Well, not really. You can think about buying those things after your student loans are paid off, own a good portion of your own home, and have a good-sized nest egg for your retirement.

Although you might envy your friend in a brand new Porsche at times, you might feel a deeper sense of accomplishment and freedom by having your financial plan and forging your path towards financial security and zero debt.

In addition, saving money and making a big dent in your debt right after residency should make you more “free” and secure during the current environment of mergers and buyouts in the realm of private practice anesthesia. If you’re not happy with the terms of the buyout of your practice (especially because you’re likely to be an employee, not a partner when you start out), it’s much easier to look for better options if you have little or no debt and have money saved in the bank. In a world where many things are out of your control, it’s empowering to know there are certain things you can do.

Summary:

-High income does not automatically make you financially secure. With a little discipline and persistence, your high income will have a good chance of translating into financial security.

Recommended Reading:

Doroghazi, Robert M. The Physician’s Guide to Investing: A Practical Approach to Building Wealth, Second Ed. Humana Press, 2009.

Lieber, Ron. “Investment Advice for Doctors: First, Do No Harm.” New York Times 26 August 2011.

Follow @MereResidency

Tweet

Are you a young physician clueless about financial matters? You’re not alone. A lot of young physicians are less than knowledgeable about what to do with money, especially with the sudden increase in income that comes about after residency. This is not surprising given that medical schools don’t usually offer any courses in financial planning. From what I’ve been able to gather, the overall process of financial planning shouldn’t be that hard, but you should have some basic framework. With some common sense, perseverance, and discipline, you will increase your likelihood of becoming financially secure.

Are you a young physician clueless about financial matters? You’re not alone. A lot of young physicians are less than knowledgeable about what to do with money, especially with the sudden increase in income that comes about after residency. This is not surprising given that medical schools don’t usually offer any courses in financial planning. From what I’ve been able to gather, the overall process of financial planning shouldn’t be that hard, but you should have some basic framework. With some common sense, perseverance, and discipline, you will increase your likelihood of becoming financially secure.

Take a look at the graph comparing compound interest to simple interest. It’s obvious that the sooner you start saving and investing money, the sooner you will reach the steeper part of the curve where the effect of compounding interest is more powerful. When it comes to saving money, you’re likely to be behind your college friends who did not go into medicine. One of the most effective way of catching up to your friends is to save a high proportion of your post-training income and investing that money early, preferably straight out of training. This way, you can reach the steeper part of the compounding interest curve sooner. Also, as a young physician not too removed from residency (or fresh out), you will find it much easier to continue to be frugal and save; it’s harder to cut back on your lifestyle once having increased it.

Take a look at the graph comparing compound interest to simple interest. It’s obvious that the sooner you start saving and investing money, the sooner you will reach the steeper part of the curve where the effect of compounding interest is more powerful. When it comes to saving money, you’re likely to be behind your college friends who did not go into medicine. One of the most effective way of catching up to your friends is to save a high proportion of your post-training income and investing that money early, preferably straight out of training. This way, you can reach the steeper part of the compounding interest curve sooner. Also, as a young physician not too removed from residency (or fresh out), you will find it much easier to continue to be frugal and save; it’s harder to cut back on your lifestyle once having increased it.